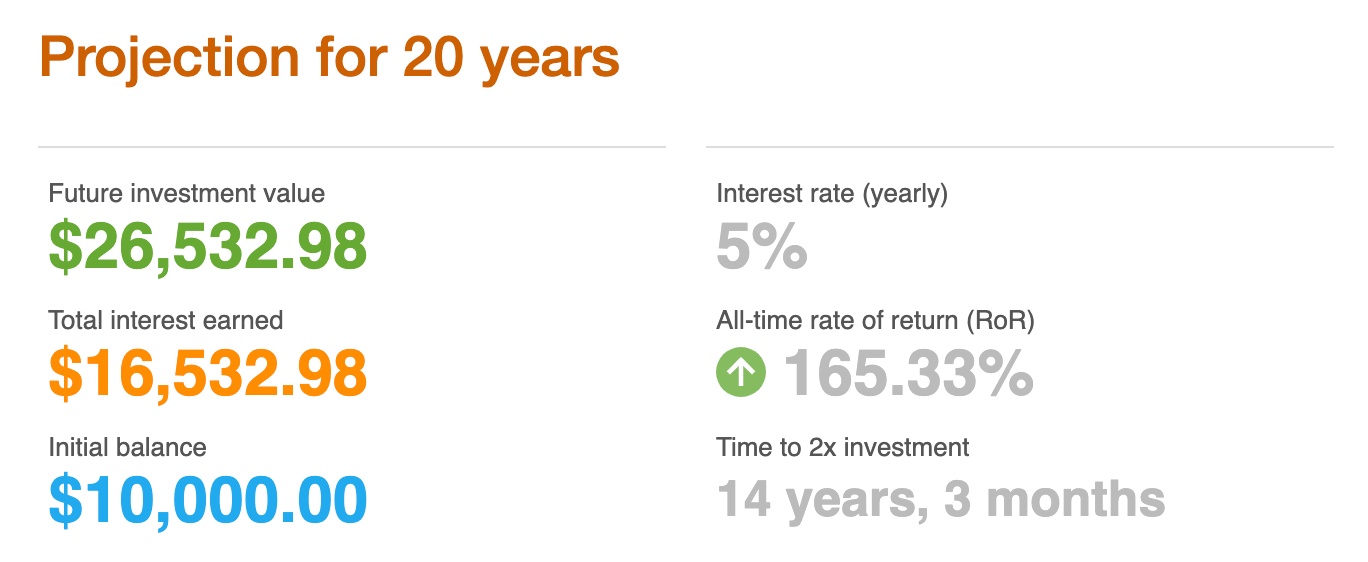

How Compound Interest Can Turn Your $10K into $26K

Time + Patience = Full Potential of your Investments Unlocked

Hey there! Remember how we talked about getting a grip on your finances being super important?

Well, this piece is going to take you deeper into that journey, focusing on something really cool: Compound Interest.

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

Albert Einstein

What Is Compound Interest?

Consider it your best friend or at least, your money’s best friend

So, compound interest might sound all fancy, but it’s actually pretty simple and super powerful. Think of it as your money making more money, then that extra money making even more money. Like a snowball getting bigger as it rolls down a hill, picking up more snow. It’s all about letting your cash grow over time.

Let’s Break It Down with an Example

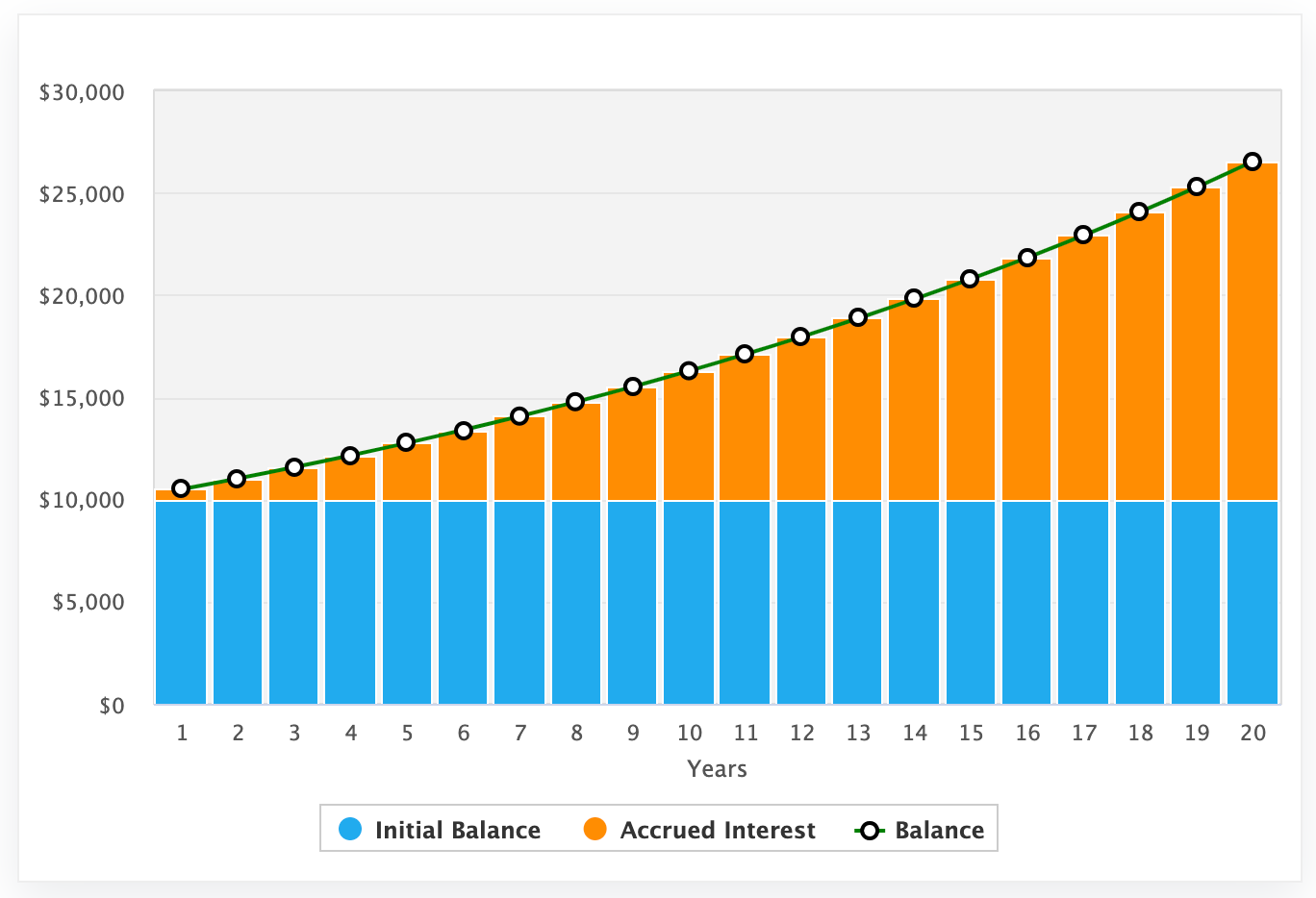

Imagine you start off with $10,000 in your investment account, and it grows at a 5% interest rate every year. But instead of checking in every year, let’s see what happens every five years:

After 5 years, you’ve got about $12,763.

After 10 years, that number jumps to around $16,289.

After 15 years, you’re looking at about $20,789.

And after 20 years? A sweet $26,533.

This shows just how wild the growth gets the longer you let your money sit and do its thing. The key here is time. The earlier you start, the more you let that money snowball roll and grow.

Click here if you want to play with the simulator yourself.

The importance of starting early

The exponential curve underlines the importance of starting to save for retirement early. The more periods that you have for compounding, the larger its effect. You can’t get to the huge returns of the 30th year of compounding without building through the first 29 years of growth.

Every year that you delay saving for retirement removes one lucrative year from the back end of the curve. Start saving as early as possible, even if it’s modest at first — it can make a huge difference a few decades down the road.

Wrapping Up

Getting started with compound interest doesn’t have to be a headache. Here’s how to get the ball rolling:

Start Now: Seriously, the sooner, the better. It gives your money more time to grow.

Keep Adding: Throw in a little money regularly, and it’ll all add up big time.

Let It Ride: Reinvest what you earn in interest, and watch your money pile get even bigger.

Be Patient: Good things take time, and with compound interest, waiting pays off.

Before You Go

Speaking of making smart moves with your money, why not check out Trade Republic? It’s a smart way to invest, spend, and bank. Use my code 3L3L4S3X to snag a welcome bonus. It’s like starting your snowball a bit higher up that hill. Get started here: https://ref.trade.re/3l3l4s3x.